Is Forex Trading Profitable? Many enter the Forex market with high hopes, but the reality can be daunting for beginners and advanced Forex traders alike. The journey to profitability is riddled with challenges and misconceptions. In this article, you will learn if Forex trading is profitable and ways to increase profit in Forex trading.

Table of contents:

Is Forex Trading profitable? The 5 Brutal Truths About Profitability

4 Ways to Increase Profit in Forex Market:

5 Things to Keep in Mind While Trading Forex

Practice Forex Trading, start with Demo Account!

What is Forex Trading?

Forex stands for foreign exchange and is the largest financial market in the world. $7.5 trillion is traded daily in 2022, making it an enticing arena for individuals seeking to capitalize on currency movements. In this article, you will learn the reasons that impact your profit and loss, as well as 5 ways to increase profit in Forex Trading.

How does Forex Trading work?

The Forex market buys and sells the exchange of one currency for another, aiming to make a profit from changes in exchange rates. Traders can speculate on currency pairs, predicting whether one currency will strengthen or weaken against another. The high liquidity and accessibility of the Forex market make it an attractive alternative for investors globally. Learn how exchange rates impact the Forex market.

Is Forex Trading profitable? The 5 Brutal Truths About Profitability

Typically, there are 70-90% losers in the Forex market, and this data may vary based on different brokers. Different types of traders employ various strategies to make a profit. It is crucial for traders to understand the risks and rewards before engaging in the market.

Market Knowledge and Analysis:

Success in Forex trading requires a deep understanding of the market. Analyzing financial indicators, geopolitical events, and technical charts can help traders make informed decisions.

Risk Management:

Unforgiving as it is, the forex market rewards discipline. Successful traders utilize risk management tools such as stop-losses and controlled positions to safeguard their wealth.

Discipline and Emotional Control:

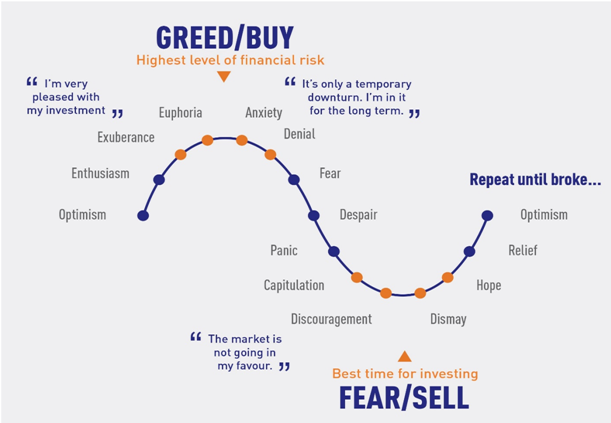

In the rollercoaster ride of Forex, emotional discipline serves as your anchor. Stay calm through the ups and downs, execute your plan flawlessly, and reap the rewards of long-term success.

Market Volatility:

The Forex market is a dynamic beast. Its ever-shifting tides of currency values can be both exhilarating and intimidating. This inherent volatility, while presenting lucrative opportunities for skilled traders, also amplifies the potential for losses. To successfully navigate these choppy waters, traders must be chameleons, adapting their strategies to suit the changing market conditions.

Technology and Tools:

As someone interested in technology, leveraging advanced trading platforms, algorithmic trading, and real-time data can enhance decision-making and execution speed.

Advanced Trading Platforms:

Sleek interfaces, real-time charts, and a data arsenal at your fingertips—these platforms serve as your Forex war rooms, replacing old-school spreadsheets with a world of trading possibilities.

Algorithmic Trading:

Forget gut checks, unleash the bots! In the financial speed run, your custom-coded trading bots react in milliseconds, executing trades based on your pre-programmed rules. No more emotion, no slip-ups – just pure, algorithmic precision guiding your every move. Learn about automated vs manual trading.

Real-Time Data:

Live feeds, news blasts, and economic whispers – your platform channels them all, fueling your strategies and letting you seize fleeting opportunities before they vanish like smoke. Trade smarter, not faster, with real-time data as your ultimate weapon.

4 Ways to Increase Profit in Forex Market:

Chart like a Pro:

Unlock market whispers with trendlines, moving averages, and MT4 indicators . Craft your perfect analysis toolkit and backtest for victory. Learn how to identify trading chart patterns and read trading charts .

Focus Firepower:

Hunt high-probability setups, not fleeting blips. Craft your signal filters, ditch bias, and let the market whisper the truth.

Steel your Defences:

Stop-loss shields, perfect position sizing, even shorting the shadows – risk management is your ultimate weapon.

Example:

10 pips stop loss

Capital | ||||||

$100 | $250 | $500 | $750 | $1,000 | ||

Lot Size | 0.01 Lot | LOW | LOW | LOW | LOW | LOW |

0.05 Lot | LOW | LOW | LOW | LOW | LOW | |

0.10 Lot | MEDIUM | LOW | LOW | LOW | LOW | |

0.20 Lot | HIGH | MEDIUM | LOW | LOW | LOW | |

0.50 Lot | HIGH | HIGH | MEDIUM | LOW | LOW | |

1.00 Lot | HIGH | HIGH | HIGH | HIGH | LOW | |

Learn what lot size is in forex.

Market Whispers:

Stay informed, diversify, and trade smart. Remember, leverage bites – play within your limits. Learn what leverage is in trading.

5 Things to Keep in Mind While Trading Forex

Chart the Course, Not Emotions.

Plan exits, learn from stumbles, and ditch the greed – discipline guides your CFD journey.

Breathe, not Chase Blips.

High probability plays slow and steady gains, resisting the FOMO (Fear of missing out) game. Patience whispers: long-term wins.

Reality Check: CFDs bite, play safe.

Ditch overnight fantasies, wealth is a slow bloom. Know your limits, and trade within your skin. ️

Market Evolves, you adapt.

Hunger for knowledge, analyze each trade, refine your CFD flame.

Tame the Inner Demons: Fear & Greed.

Logic shields your trades, and stress resilience fuels your CFD climb. Believe in your game, long-term wins await.

Conclusion:

Profits in the Forex market are undeniable, but sustainable wins lie not in impulsive clicks or the siren song of every blip but in a mindful tango between seizing opportunity and managing risk.

Mindset: Cultivate calm, trade with logic, embrace learning.

Strategy: Map your path, backtest your moves, adapt without losing focus.

Skills: Sharpen analysis, seek knowledge, practice in the demo account .

Within you lies the potential to unlock the Forex treasure chest. Embrace the journey, embrace the growth. Start forex trading now.

FAQs

Can I make money from Forex Market?

Yes, but profits aren’t guaranteed. It’s risky, so only invest what you can afford to lose.

Example: Maria studied Forex for a year and started with a small account. She practised sound risk management and grew her profits steadily. Learn how to trade forex for beginners.

How much profit can I make from the Forex Market?

Varies greatly based on skill, strategy, and market. Some make big profits, others lose. Set realistic expectations.

Example: A skilled trader with a $10,000 account and a 10% monthly return would make a $1,000 profit.

Risks of Forex Trading?

Big market swings!

Some currencies are hard to trade quickly.

Tech glitches can burn you.

Leverage multiplies both profits & losses. Learn why leverage is high in the Forex .

Example of market volatility: A sudden political event causes a currency to plummet, leading to losses for those holding positions in it.

Example of liquidity risk: A trader struggles to exit a position in an illiquid currency pair, resulting in a missed opportunity or a larger loss than anticipated.

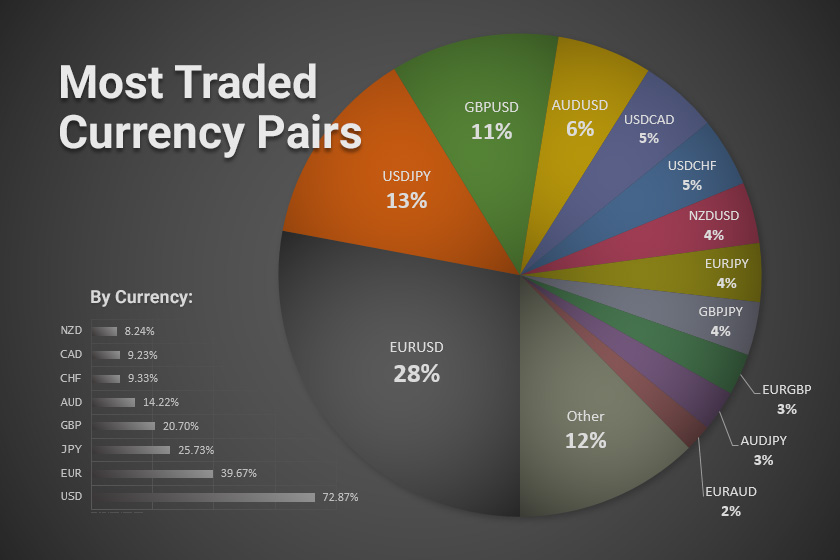

Check out the most traded currency pairs and most traded exotic currency pairs .

How can I profit from the Forex Market?

Educate yourself, develop a plan, and choose a good broker. Start small & learn.

Example of trading plan: Defining entry and exit points, stop-loss orders, and risk management rules.

Example of a reliable broker: Choose a broker regulated by a reputable financial authority with a good reputation for customer service.

Where can I learn to trade Forex?

Online courses, market news , books, websites, trading strategies , and communities. Never stop learning! Learn how to become a trader .

Online courses: Babypips School of Pipsology, Udemy Forex courses.

Investing websites: Investopedia, Forex Factory.

Webinars and seminars: Offered by brokers and financial institutions.

Practice Forex Trading, start with Demo Account!

Ready to roll? Two paths, one goal. Go full-throttle with a live account, where every decision’s a heart-pumper and the market becomes your playground. Or, test-drive your skills risk-free in our demo account. Either way, you’ll get exclusive resources, expert whispers, and a community cheering you on.